Discover Wyoming Federal Credit Union: Your Trusted Financial Partner

Join the Motion: Why Federal Lending Institution Issue

In the realm of financial organizations, Federal Credit history Unions stand out as columns of community-focused financial, however their importance expands beyond standard banking solutions. As we unwind the layers of their effect on neighborhoods and individuals alike, it comes to be apparent that Federal Credit score Unions hold the key to a much more flourishing and fair economic landscape.

Background of Federal Lending Institution

Given that their inception, Federal Cooperative credit union have played a pivotal role in the monetary landscape of the USA. The history of Federal Lending institution go back to the very early 20th century when the Federal Cooperative Credit Union Act was authorized into law by Head of state Franklin D. Roosevelt in 1934. This Act was an action to the Great Anxiety, intending to promote thriftiness and protect against usury by offering economical debt to participants.

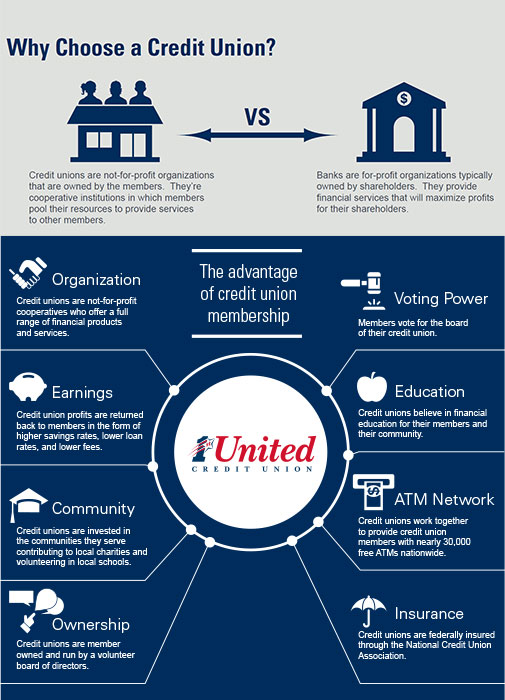

The Act allowed teams of people with a typical bond, such as staff members of the same business or participants of a labor union, to form credit unions. These credit scores unions were developed as not-for-profit economic cooperatives, possessed and run by their members. The participating structure allowed individuals to pool their resources and offer access to budget friendly finances and various other financial services that may not have been offered to them via conventional financial institutions.

For many years, Federal Cooperative credit union have actually continued to grow in number and influence, serving countless Americans nationwide. They have stayed committed to their starting principles of neighborhood focus, member ownership, and financial inclusion.

Special Solutions Offered by Lending Institution

Furthermore, credit report unions typically use lower interest prices on finances and credit cards contrasted to bigger banks. This can result in considerable price savings for members, particularly for those looking for to obtain cash for large purchases such as cars and trucks or homes. In addition, cooperative credit union often give greater interest rates on interest-bearing accounts, enabling members to expand their cash extra successfully.

Another unique solution provided by cooperative credit union is profit-sharing. As not-for-profit organizations, lending institution distribute their revenues back to participants in the kind of dividends or minimized costs. This cooperative framework cultivates a feeling of common ownership and area among members, strengthening the idea that cooperative credit union exist to offer their members' ideal rate of interests.

Benefits of Subscription in Cooperative Credit Union

Signing up with a lending institution supplies members a host of substantial advantages that come from the establishment's member-focused method to economic services. Unlike traditional financial institutions, cooperative credit union are not-for-profit organizations possessed and run by their participants. This distinct framework permits cooperative credit union to focus on the most effective rate of interests of their participants above all else, leading to several benefits for those that select to sign up with.

Community Impact of Lending Institution

Cooperative credit union play an essential duty in promoting financial stability and growth within regional neighborhoods via their one-of-a-kind economic solutions model. Unlike traditional banks, cooperative credit union are member-owned and ran, permitting them to focus on offering the most effective passions of their participants instead of generating revenues for investors. This member-centric method translates into substantial advantages for the area at large.

One significant means debt unions effect communities is by providing accessibility to budget friendly financial product or services. Cheyenne Credit Unions. From low-interest lendings to affordable cost savings accounts, credit report unions provide a large range of choices that assist individuals and small companies flourish. By reinvesting their profits back into the area in the form of reduced costs, higher interest prices on down payments, and better funding terms, credit score unions add to the general economic wellness of their participants

Additionally, lending institution usually focus on monetary education and learning and outreach efforts, gearing up area participants with the expertise and resources required to make sound economic decisions. By supplying financial proficiency programs, workshops, and individually counseling, lending institution encourage people to accomplish greater economic self-reliance and safety. In general, the community influence of cooperative credit union goes beyond simply banking services; it encompasses developing more powerful, more durable neighborhoods.

Future Development and Trends in Cooperative Credit Union

In the middle of progressing economic landscapes visit this site and moving consumer choices, the trajectory of lending institution is poised for vibrant adaptation and development. Modern technology will certainly play a crucial role in shaping the future development of debt unions. As more purchases relocate to electronic platforms, lending institution are enhancing their on the internet solutions to satisfy member assumptions for comfort and performance. Embracing fintech partnerships and investing in advanced cybersecurity actions will certainly be critical for credit scores unions to remain competitive and protected in the electronic age.

Furthermore, sustainability and social duty are emerging as essential fads affecting the development of cooperative credit union. Members are progressively looking for banks that align with their values, driving credit history unions to incorporate ecological and social initiatives into their procedures (Cheyenne Federal Credit Union). By prioritizing sustainability techniques and area development projects, credit scores unions can attract and retain members that focus on moral financial methods

Verdict

Finally, federal debt unions play a critical function in promoting monetary stability, area empowerment, and inclusivity. With their special solutions, participant possession framework, and commitment to reinvesting in the neighborhood, cooperative credit union focus on the well-being of their members and add to building stronger neighborhoods. As they remain to expand and adjust to transforming fads, cooperative credit union will stay a crucial force beforehand monetary self-reliance for all people.

The history of Federal Credit Unions dates back to the very early 20th century when the Federal Debt Union Act was signed into law by Head of state Franklin D. Roosevelt in 1934.The Act enabled groups of people with a common bond, such as employees of the same business or members of a labor union, to form credit scores unions.Moreover, credit report unions usually provide reduced rate of interest rates on fundings and credit report cards contrasted to bigger economic organizations.Furthermore, credit rating unions commonly prioritize monetary education and outreach campaigns, outfitting community participants with the knowledge and sources needed to make audio monetary the original source decisions. Through their one-of-a-kind services, participant possession framework, and dedication to reinvesting in the neighborhood, credit unions focus on the wellness of their participants and contribute to constructing more powerful neighborhoods.